I’m pretty averse to investing in companies laden with debt on the balance sheet. But with a 25-year history of raising its dividend and a pipeline of growth opportunities, National Grid (LSE: NG.) shares are an exception to this rule.

Debt mountain

During H1 FY24, net debt rose 7% to stand at £43.9bn. A large chunk of that increase was down to capital investment in the period of £3.6bn. By financial-year end, it’s expecting debt will grow by another £500m.

It’s becoming clear that delivering the electricity infrastructure that will make net zero a reality, doesn’t come cheap.

Despite a mammoth debt position, around 70% sits within its regulated operating companies. Consequently, it has a high degree of regulatory protection.

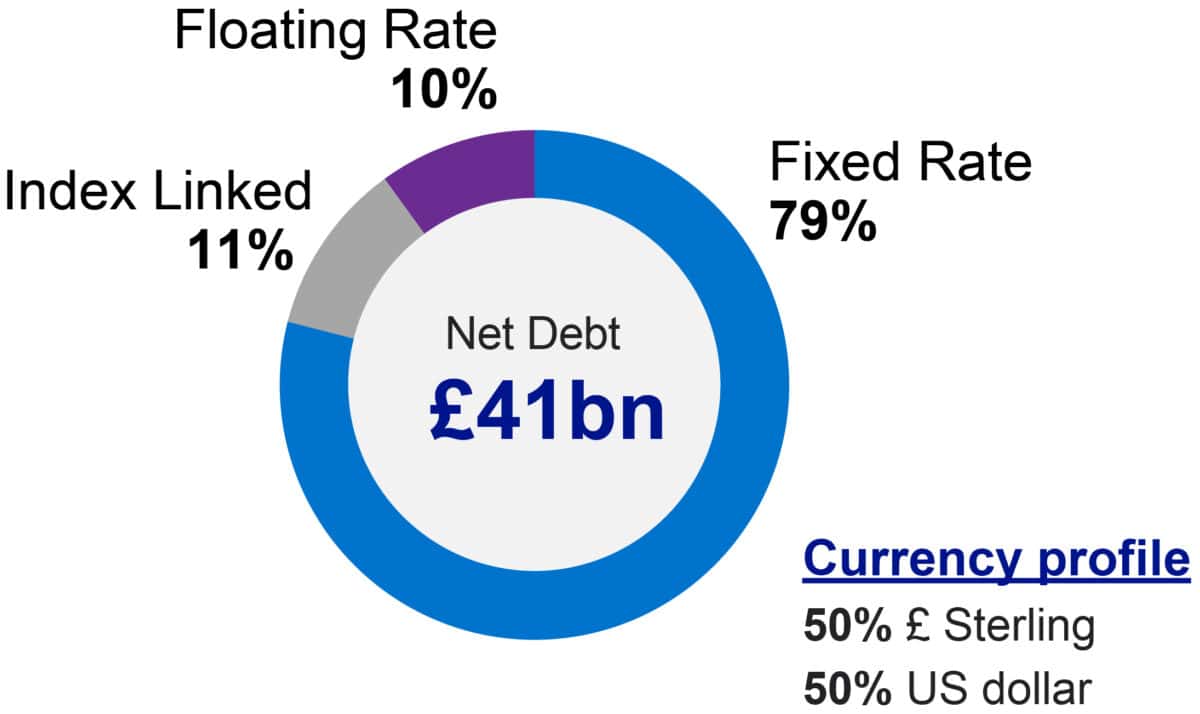

The following infographic shows the profile of its overall debt book, as at 31 March 2023. With so little index-linked, and with an average maturity of 11 years, I’m not unduly concerned.

Source: National Grid

Electricity distribution – a growth industry

When most people talk about electricity infrastructure, they’re referring to the extra-high-voltage cables that transport electricity across the country.

But how is electricity managed once it comes off the grid? The answer is by geographical monopolies, known as distribution network operators (DNOs). National Grid owns the largest of these DNOs.

This sector has huge growth potential, in my opinion. Regulatory asset value (RAV), a key metric in this industry, is expected to grow 10% annually to 2026. RAV is the value employed by the regulator, Ofgem, when it comes to laying out how much a DNO can charge.

The reasons for this explosive growth are multiple. One key factor is connections growth. If I want to connect my home EV charger to the network, I need to seek the permission of my local DNO. If an organisation wants to connect a solar farm or battery storage to the network, then it has to pay for that privilege.

To provide just one example, National Highways has just begun implementing a scheme that will see an explosion of rapid EV charging stations across all of England’s motorway service areas.

Reliable dividend payer

National Grid has an enviable track record when it comes to dividends.

In the last financial year, it increased its dividend per share by 9% to 55.44p. That equates to a market-beating yield of 5.5%. And it’s committed to growing the dividend in line with CPIH, which is consumer prices index including owner occupiers’ housing costs.

One issue that concerns me is the pace of net zero adoption. Over the past year, awareness has grown concerning the practical challenges associated with delivering it. One thorny issue is planning.

It’s becoming abundantly clear that urgent planning reform is required. Without that, there’s little incentive for the supply chain to commit to long-term investment decisions.

National Grid requires a financial framework that fairly represents the proportionate risk and reward of the work required. If net zero stalls, therefore, its share price could be impacted. Nevertheless, I view it as a low-risk play and an easy way to gain exposure to the emerging green economy. For me personally, it’s a buy.